In the first of two blogs, we look at the current volatile energy market and what we mean by dynamic risk management and energy purchasing as an approach to managing volatility. The second blog looks at proactively incorporating renewables to hedge market risks and create a more balanced energy strategy for your business.

Introduction

Highly volatile energy markets justifiably dominate the headlines and should be an area of great concern and focus for data centres.

While the UK government’s business energy support will shield some against volatile prices there is still much uncertainty beyond April 2023 when the scheme ends.

Here, we discuss managing market volatility using a dynamic approach that combines risk management and energy purchasing.

The current volatility in context

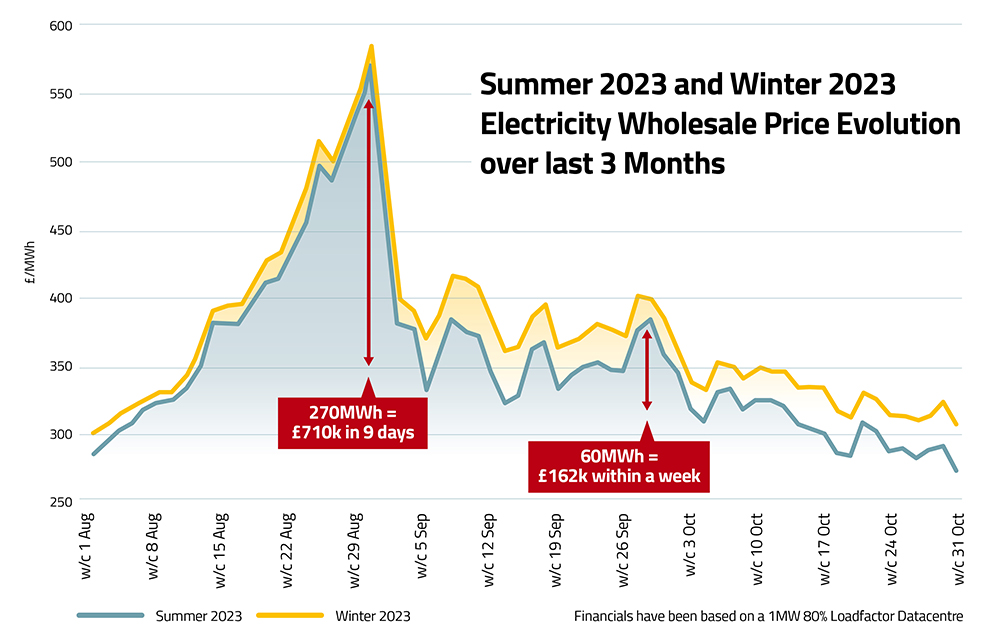

The graph below shows what volatility means in financial terms for a 1 megawatt (MW), 80% load-factor data centre.

Taking the first spike in August, the swing in price over 9 days was approximately £270MWh, equating to £710K for a 1MW data centre.

Even with a falling market, we’ve seen over £60MWh swings, which is where power prices were two years ago, but we’re now seeing these swings within a week.

Adopting dynamic risk management and purchasing

In our experience, data centres are looking for a clearly defined strategy and approach that delivers a competitive price and cost certainty that meets their tenants’ requirements. This can be achieved with a dynamic risk management and energy purchasing strategy, which data centres are well placed to implement as best practice.

With the current energy market fluctuations, at Noveus Energy, we monitor markets daily, advising our customers when to buy and sell, including how to deal with all too often price spikes and when to switch buying tactics to take advantage of market volatility.

Described above is a dynamic approach that delivers a lower commodity cost by maximising the benefit of market volatility and limiting the risk of buying on the wrong day when prices are artificially high. It requires an in-depth understanding of the market, daily analysis, and ongoing adjustments to deliver a lower price than the average market, with decisions constantly reviewed.

In normal market conditions and with a dynamic approach, you can save up to 10% on energy procurement. However, you could achieve more savings in today’s highly volatile environment. Still, you must be fleet of foot – daily, weekly – as the market is changing all the time rapidly.

Ready for a more dynamic approach?

If you want to adopt a more dynamic strategy, please don’t hesitate to get in touch via our contact page.

To understand how renewables can be incorporated into your risk management and energy purchasing strategy, take a look at the second blog in this series ›